I spent pretty much all of 2020 going through a roller-coaster, much like many of you reading this. Well – maybe a little more, given that I was worried initially that if a consultant stops travelling, does the market stop buying, and should I be worried about my job, and therefore my ability to live in US, give that I am in the Green Card queue like many others. Thankfully, that did not happen, I continued selling work to my clients, and continued working for the firm. However, the one thing that I did, was once in a while, put $50-$150 in my Coinbase and Binance accounts and buy some cryptocurrency. And even though I did not see any returns, I looked at it as risk I was willing to take. And somehow I did not buy the big ones – I didn’t buy BTC, ETH, LTC, etc. I bought those that looked like they had long run future, those that were platforms like ETH and would eventually either fork or become big because other apps would come on it. How did I know to do this? I have no answer. I kept buying small amounts every month, a little HOT, a little ADA, a little TRX. And then came November 2020.

The Elections

November 2020 – the longest election cycle that I have seen in US, granted that I have only been here about 13 years. But it was interesting, to say the least. I didn’t have a horse in the race, so it made it easier to look at the elections objectively. That did not help. But at least it was entertaining. On one of those post election day evenings, I was watching the news and admiring my crypto portfolio (mostly because I had to make sure that I was in compliance with my firm’s requirements – real issues when you work for an Audit firm, even if you are in advisory). So, I was watching CNN and working away on my laptop, when I noticed a slight uptick in the market when they (CNN/FOX/AP/etc.) announced the results. Then it happened again a few days later when the state governments threw out the claims of voter fraud. And once again when the incumbent presidential team allowed access to the incoming administration’s team. [See the three red arrows below.]

One can’t help but wonder, if this was a sign of (some) people realizing that we could have some semblance of normalcy soon. But what is the definition of normal? We had a new normal created for us, in the past 4 years of presidency. We had a new normal created for us by COVID-19. And as a result of that and some amazing fires (CA,CO), we (in the tech/crypto world) had a new normal created because those who could barely afford a 2 bed room apartment in SF, decided to move to Texas, Florida, Colorado, and suddenly had a significant part of their income as disposable (read investable).

Maybe it was all of the above that led to the public (loosely used term here) thinking that we can go back to a real normal – normal.

COVID Vaccinations

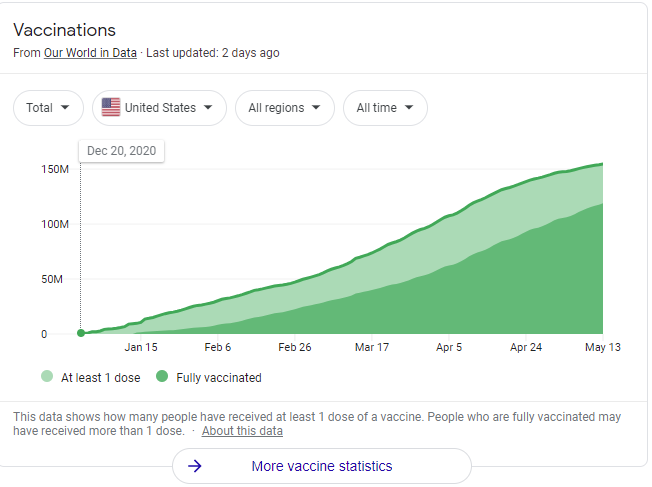

On December 14th, the first vaccinations were released, the news came out the same day. And then around December 17-18th, the news of mass vaccinations starting across the US started trickling in.

December 20th, US crossed 0.5 million vaccinated, and then by January 15th, 1M people fully vaccinated.

It started giving the feel that things will become normal. And with that, the concept of Permanent Income Hypothesis kicked in.

Permanent Income Hypothesis

For the uninitiated, here’s the simple version of the theory.

It supposes that a person’s consumption at a point in time is determined not just by their current income, but also by their expected income in future years—their “permanent income”.

It basically tells us that on average people spend money when they are expecting their income to come in, but not necessarily on the days of the the income itself. The way we saw this theory play out, was that as people got more comfortable with the fact that jobs will return, and the salary will become predicatable again, their spending patterns will return to a normal pattern.

In my opinion – many people had reset their lifestyles to be prepared for the worst, and had gotten into a habit of spending less. We have many consumer spending reports that show how 2020 was one of the lowest years for general consumer spend. It is fair to assume that as people thought their source of income will become more stable, and suddenly realized that they had a little spare every month that they could invest with.

Reddit, Robinhood, Gamestop, DOGE, Elon Musk, Mark Cuban

It will be unfair to claim that common folk who were busy trying to survive the pandemic, suddenly woke up and started thinking of investing. That’s where the media comes into play. We had spent the last 10 months glued to our screens, because that’s all we could do – watching the craziness unfold, unable to go out ourselves, media and entertainment industry, and online forums were our best friends. So when a small group of Robinhood-reditters (that’s just what I call them), hit back at the big investment firms by making GameStop stocks skyrocket, it made headlines. And investment, and investment based riches, got the spotlight. The next were the wave of Tesla millionaires, which turned the attention to the world’s very own real life Tony Stark – Mr. Elon Musk. Never to shy away from publicity, and apparantly with a substancial investment the largest of the meme-coins – DOGE, Mr. Musk started tweeting about it. And his 54M followers, started buying it with the hopes of making millions themselves. And don’t get me wrong – many did. Especially when Mark Cuban, the famed owner of Dallas Mavericks and Shark-tank investor, tweeted that Mavericks will accept DOGE as payment for tickets. This much publicity – when people are already glued to the screens – and looking for some respite after some substantial political mockery – pushed the crypto market on the dance floor. And then the moves came out.

Final Observation and Conclusion Hypothesis

I have been meaning to write this for a while. But I wanted to see some trends before I finally put fingers on the keyboard. And the trend became more an more visible in the last 4 months. So here it goes.

The perfect storm happens when many events converge. In this case, all of the above events converged to create what will be known as the “Crypto Boom of 2021” and used in behavioral economic lecutres in future MBA programs.

As cryptocurrency took centerstage, people realized that things will go back to normal, more and more people got (and continue to get) vaccinated, people also realized that crypto investment can be a shortcut to wealth. This is where the Permanent Income Hypothesis started showing up. If you look at the graph below, you will notice the following patterns, which are confirmed by the researches that have been done before me. [Disclaimer: My work is not research, it is merely observations of one man.]

- Crypto market starts going up about 4-6 days before month end. This is in-line with people expecting to get salaries 2 days before month end, and in anticipation of that, investing in crypto currencies. This is also aligned with behaviors observed through the Permanent Income Hypothesis. The spend starts 4-5 days before month end, and goes till 6th of the month.

- The investment stabilizes from 6th, and then drops from 8th to 10th/11th of the month. Almost as if there is a realization of overspending and no immediate returns more than 10-15% (at least on the big coins – BTW, ETH, etc.)

- The market takes a small jump on 13th/14th – again in anticipation of the US mid-month salary cycle. However, since the crypto market is not restricted to US only, this increase is not as significant as the global month end/month start salary cycle.

- The market keeps going up (at a lesser angle) for another 4-6 days. And then does the same stabilize to 22nd and and dip till 26th of the month.

- And then the cycle begins again….

Excellent read.. love the final observations..